Bank of England base rate

Its part of the Monetary Policy action we take to meet the target that the Government sets us to keep inflation low and stable. Bank of England base rate change.

Two Years And Counting Bank Of England Still Trying To Decode Labor Market Labour Market Bank Of England Decoding

It was then raised from 05.

. Contact us Online Banking opens in a new window. On 17 March 2022 the Bank of England base rate increased from 050 to 075. Read our base rate FAQs.

The Bank of England BoE is the UKs central bank. Theres no need to speak to us. Wed also like to use some non-essential cookies including third-party cookies to help us improve the site.

Our use of cookies. This means we may increase or decrease interest rates at any time for example to reflect a change in the Bank of England base rate or if there are changes in market conditions. For further information on how and when please refer to Condition 7 of our.

Follow-on Rate FoR Santanders Follow on Rate FoR will be 400 from the beginning of April Bank of England base rate plus 325. You can view your new interest rate here. The Co-operative Bank will work closely with our customers colleagues and partners to support those in need.

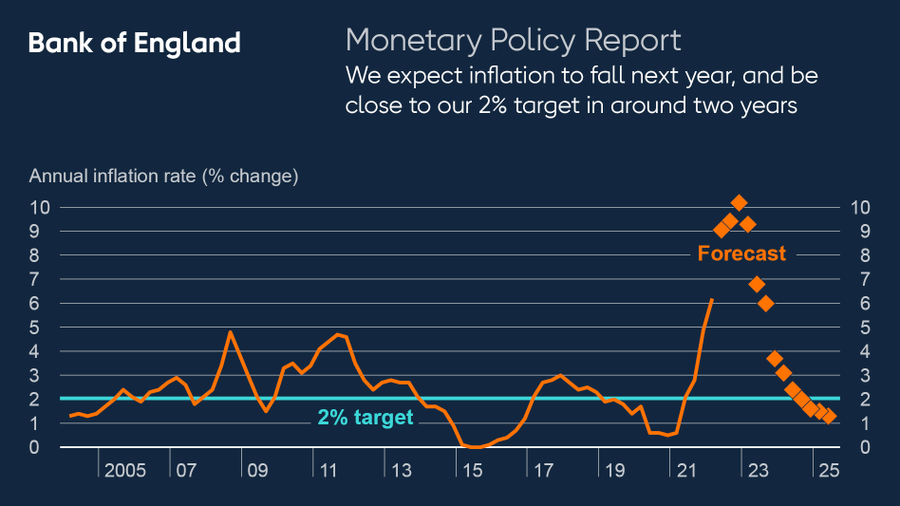

The Bank of England has increased base rates to 075 from 05 after the Monetary Policy Committee MPC voted in favour of a rise. The MPC made the decision in response to CPI inflation rising to 54 a figure well above the Banks target of 2. The base rate is used by the central bank to charge other banks and lenders when they borrow money and influences what borrowers pay and savers earn.

Our mission is to deliver monetary and financial stability for the people of the United Kingdom. Santanders FoR is a variable rate that all mortgage deals taken on or after 23 January 2018 will automatically transfer to. Were planning to carry out scheduled testing of our systems so we can continue to provide the best possible service.

So far in 2022 the Bank of England has upped its base rate twice. Following the recent Bank of England Base Rate increase the rates on some existing variable savings accounts increased on 14 April. We use necessary cookies to make our site work for example to manage your session.

Bank of England Base Rate update As you may know on 17th March the Bank of England increased the bank base rate from 050 to 075. Our Monetary Policy Committee MPC sets Bank Rate. Homes for Ukraine scheme.

The Bank of Englands Monetary Policy Committee MPC has voted by a slender majority of 5-4 to increase the base rate by 025 percentage points. HMRC interest rates are linked to the Bank of England base rate. Bank Rate determines the interest rate we pay to commercial banks that hold money.

As a result of this announcement we wanted to let you know about changes we are making which may affect you. Includes the Base Rate increase to 075 in March 2022 and MPC meeting dates for 2022. Bank of England rate increase.

Can Sainsburys Bank change the interest rate. The Bank of England Monetary Policy Committee voted on 17 March 2022 to increase the Bank of England base rate to 075 from 050. If this affects you well be in touch soon.

In February it was raised from 025 to 05. Bank of England hikes base rate to 05. After much speculation the central bank voted in December to increase the base rate to 025 percent having previously held back on the decision due to fears over the strength of the jobs market.

We will contact you to tell you if your interest rate changes. We stand with the people of Ukraine. Read our position on Ukraine in full.

In the news its sometimes called the Bank of England base rate or even just the interest rate. Close Skip to content. Discover what the current Bank of England base rate is when the next Bank of England MPC meeting is when the interest rate could increase how the base rate can affect your mortgage and how it is affected by Brexit and coronavirus.

Our unique Ethical Policy. The Bank of England base rate has changed.

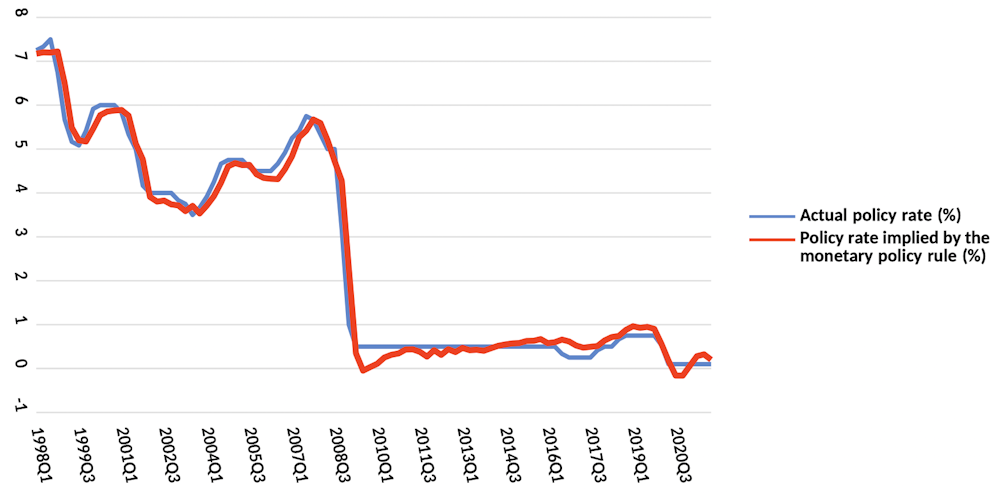

I Ve Fine Tuned A Tool That Advises The Bank Of England What Interest Rates To Set Here S What It Says

Historical Interest Rates Uk Economics Help Interest Rates Economics Rate

Traders Bet U K Will Have Negative Interest Rates By Year End Bank Of England Interest Rate Swap Uk Banks

Uk Housing Market Economics Help Mortgage Rates Bank Rate Mortgage Lenders

How The Bank Of England Set Interest Rates Economics Help

How The Bank Of England Set Interest Rates Economics Help

The 5 000 Year History Of Interest Rates Shows Just How Historically Low Us Rates Are Right Now Gold Rate Interest Rates Low Interest Rate

Pin On Numerology January 2020

Uk Interest Rates Rise For First Time In 10 Years Interest Rate Chart Interest Rates Rate

Historical Interest Rates Uk Economics Help Interest Rates Economics Rate

Traders Low Expectations For Boe Rate Stir Complacency Debate Debate Expectations How To Plan

0 Response to "Bank of England base rate"

Posting Komentar